Dec 2, 2024

Contribution Margin Formula + Calculator

The company will use this “margin” to cover fixed expenses and hopefully to provide a profit. Let’s begin by examining contribution margin on a per unit basis. Enter the selling price per unit, variable cost per unit, and the total number of units sold into the contribution margin calculator. The calculator will display the contribution margin amount and ratio in percentage.

Company

Increase revenue by selling more units, raising product prices, shrinking product size while keeping the same cost, or focusing on selling products with high margins. Investors often look at contribution margin as part of financial analysis to evaluate the company’s health and velocity. Fixed and variable costs are expenses your company accrues from operating the business. Contribution Margin Ratio (CMR) is a measurement tool found on a company’s income statement and its balance sheet. The CMR indicates the amount of income a company has left over after all its expenses have been paid. This tool is essential in helping to determine how much money is available for distribution to owners as dividends and how much money is available for reinvestment in the company.

What is the Contribution Margin Ratio?

When allocating scarce resources, the contribution margin will help them focus on those products or services with the highest margin, thereby maximizing profits. 1) It helps you determine how much money your business generates on every dollar of sales. what is a note payable definition nature example and journal entries You can use this information to determine whether your business is profitable or not and whether it is growing or not (if your contribution margin percentage changes). It is essential to understand contribution margins in healthcare because.

Contribution Margin Formula

- Accordingly, the contribution margin per unit formula is calculated by deducting the per unit variable cost of your product from its per unit selling price.

- If they send nine to sixteen students, the fixed cost would be \(\$400\) because they will need two vans.

- Accordingly, the net sales of Dobson Books Company during the previous year was $200,000.

- At the product level In a manufacturing company, variable costs change, depending on the volume of production.

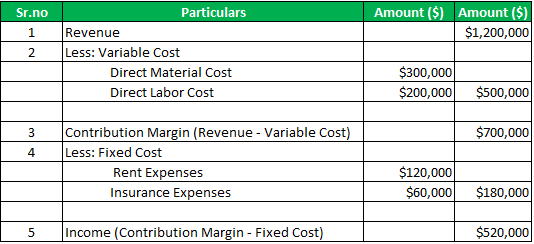

As mentioned above, contribution margin refers to the difference between sales revenue and variable costs of producing goods or services. This resulting margin indicates the amount of money available with your business to pay for its fixed expenses and earn profit. A company’s contribution margin is significant because it displays the availability of the revenue after deducting variable costs such as raw materials and transportation expenses. To make a product profitable, the remaining income after variable costs must be more than the company’s fixed costs, such as insurance and salaries. One of the important pieces of this break-even analysis is the contribution margin, also called dollar contribution per unit. Analysts calculate the contribution margin by first finding the variable cost per unit sold and subtracting it from the selling price per unit.

Get in Touch With a Financial Advisor

To get the ratio, all you need to do is divide the contribution margin by the total revenue. Conceptually, the contribution margin ratio reveals essential information about a manager’s ability to control costs. The contribution margin may also be expressed as a percentage of sales. When the contribution margin is expressed as a percentage of sales, it is called the contribution margin ratio or profit-volume ratio (P/V ratio). Reduce variable costs by getting better deals on raw materials, packaging, and shipping, finding cheaper materials or alternatives, or reducing labor costs and time by improving efficiency.

A contribution margin represents the money made by selling a product or unit after subtracting the variable costs to run your business. To run a company successfully, you need to know everything about your business, including its financials. One of the most critical financial metrics to grasp is the contribution margin, which can help you determine how much money you’ll make by selling specific products or services. The contribution margin ratio refers to the difference between your sales and variable expenses expressed as a percentage. That is, this ratio calculates the percentage of the contribution margin compared to your company’s net sales. Decisions can be taken regarding new product launch or to discontinue the production and sale of goods that are no longer profitable or has lost its importance in the market.

The contribution margin formula is calculated by subtracting total variable costs from net sales revenue. In other words, contribution margin per unit is the amount of money that each unit of your product generates to pay for the fixed cost. Accordingly, the contribution margin per unit formula is calculated by deducting the per unit variable cost of your product from its per unit selling price. Thus, the level of production along with the contribution margin are essential factors in developing your business. Now, it is essential to divide the cost of manufacturing your products between fixed and variable costs. The contribution margin is a measurement through which we understand how much a company’s net sales will contribute to the fixed expenses and the net profit after covering the variable expenses.

The contribution margin ratio of a business is the total revenue of the business minus the variable costs, divided by the revenue. It also results in a contribution margin ratio of $14/$20, or 70%. A key characteristic of the contribution margin is that it remains fixed on a per unit basis irrespective of the number of units manufactured or sold. On the other hand, the net profit per unit may increase/decrease non-linearly with the number of units sold as it includes the fixed costs. The contribution margin shows how much additional revenue is generated by making each additional unit of a product after the company has reached the breakeven point. In other words, it measures how much money each additional sale “contributes” to the company’s total profits.

Fixed costs are costs that are incurred independent of how much is sold or produced. Buying items such as machinery is a typical example of a fixed cost, specifically a one-time fixed cost. Regardless of how much it is used and how many units are sold, its cost remains the same. However, these fixed costs become a smaller percentage of each unit’s cost as the number of units sold increases. This means that the production of grapple grommets produce enough revenue to cover the fixed costs and still leave Casey with a profit of $45,000 at the end of the year. The concept of this equation relies on the difference between fixed and variable costs.

This metric is typically used to calculate the break even point of a production process and set the pricing of a product. They also use this to forecast the profits of the budgeted production numbers after the prices have been set. You can use a spreadsheet, such as Google Sheets or Microsoft Excel, to include columns by product, enabling you to compare the contribution margin for each of your business products.

The profitability of our company likely benefited from the increased contribution margin per product, as the contribution margin per dollar increased from $0.60 to $0.68. Next, the CM ratio can be calculated by dividing the amount from the prior step by the price per unit. The analysis of the contribution margin facilitates a more in-depth, granular understanding of a company’s unit economics (and cost structure). The contribution ratio is a measurement of your overall financial health. It’s calculated by dividing your net income by your total expenses.