Nov 29, 2024

Contribution Margin Ratio CM Formula + Calculator

Let us try to understand the concept with a contribution margin example. One common misconception pertains to the difference between the CM and the gross margin (GM). Learn about the time interest earned ratio and how to calculate it. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

How to calculate the contribution margin and the contribution margin ratio?

You pay fixed expenses regardless of how much you produce or sell. It includes the rent for your building, property taxes, the cost of buying machinery and other assets, and insurance costs. Whether you sell millions accumulated depreciation and depreciation expense of your products or 10s of your products, these expenses remain the same. You can even calculate the contribution margin ratio, which expresses the contribution margin as a percentage of your revenue.

- It is important for you to understand the concept of contribution margin.

- The contribution margin represents how much revenue remains after all variable costs have been paid.

- Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

- A high margin means the profit portion remaining in the business is more.

- The business can interpret how the sales figures are affecting the overall profits.

Everything You Need To Master Financial Modeling

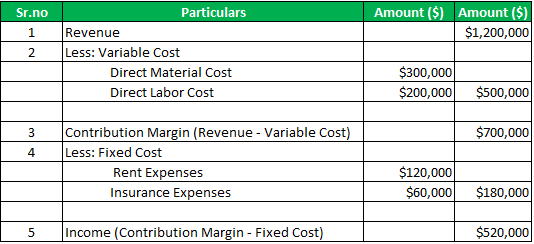

As a business owner, you need to understand certain fundamental financial ratios to manage your business efficiently. These core financial ratios include accounts receivable turnover ratio, debts to assets ratio, gross margin ratio, etc. The formula to calculate the contribution margin ratio (or CM ratio) is as follows. To illustrate how this form of income statement can be used, contribution margin income statements for Hicks Manufacturing are shown for the months of April and May.

Understanding Contribution Margin

We will look at how contribution margin equation becomes useful in finding the break-even point. As of Year 0, the first year of our projections, our hypothetical company has the following financials. Soundarya Jayaraman is a Content Marketing Specialist at G2, focusing on cybersecurity. Formerly a reporter, Soundarya now covers the evolving cybersecurity landscape, how it affects businesses and individuals, and how technology can help.

Is contribution margin the same as profit?

You can use contribution margin to help you make intelligent business decisions, especially concerning the kinds of products you make and how you price those products. The Contribution Margin Calculator is an online tool that allows you to calculate contribution margin. You can use the contribution margin calculator using either actual units sold or the projected units to be sold.

Results Generated

The Indirect Costs are the costs that cannot be directly linked to the production. Indirect materials and indirect labor costs that cannot be directly allocated to your products are examples of indirect costs. Furthermore, per unit variable costs remain constant for a given level of production.

Fixed costs include periodic fixed expenses for facilities rent, equipment leases, insurance, utilities, general & administrative (G&A) expenses, research & development (R&D), and depreciation of equipment. The contribution margin is the leftover revenue after variable costs have been covered and it is used to contribute to fixed costs. If the fixed costs have also been paid, the remaining revenue is profit.

You can find her extensive writings on cloud security and zero-day attacks. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

There is no definitive answer to this question, as it will vary depending on the specific business and its operating costs. However, a general rule of thumb is that a Contribution Margin above 20% is considered good, while anything below 10% is considered to be relatively low. If the company realizes a level of activity of more than 3,000 units, a profit will result; if less, a loss will be incurred. The following examples show how to calculate contribution margin in different ways. Fixed costs are one-time purchases for things like machinery, equipment or business real estate.

The overall contribution margin is computed using total sales and service revenue minus total variable costs. When calculating the contribution margin, you only count the variable costs it takes to make a product. Gross profit margin includes all the costs you incur to make a sale, including both the variable costs and the fixed costs, like the cost of machinery or equipment.

Below is a breakdown of contribution margins in detail, including how to calculate them. Now, let’s try to understand the contribution margin per unit with the help of an example. Therefore, we will try to understand what is contribution margin, the contribution margin ratio, and how to find contribution margin. We explain its formula, differences with gross margin, calculator, along with example and analysis.